Trust Fund Credifin for Comprehensive Debt Collection Solutions

Wiki Article

Proven Techniques for Lending Collection: Trust Fund the Specialists

In this write-up, we will assist you through the funding collection procedure, offering reliable interaction techniques, arrangement strategies, and pointers on utilizing innovation. Discover finest techniques for legal actions in financing collection.Understanding the Finance Collection Process

To understand the funding collection procedure, you require to trust the specialists that are experienced in this area. They have the knowledge and experience to navigate the complex world of financial obligation recuperation. These professionals understand the ins and outs of the legal framework surrounding car loan collection as well as can supply beneficial understandings right into the ideal practices for recovering arrearages.Car loan collection is not as basic as sending a few tips or making a few telephone call. It needs a tactical method, tailored to each individual borrower's circumstances. The specialists have a deep understanding of the various collection approaches readily available and also can figure out one of the most efficient program of action for each case.

By relying on the experts, you can make sure that the funding collection process is conducted professionally and also successfully. They have the needed tools and also sources to locate as well as connect with consumers, discuss repayment terms, as well as, if necessary, initiate lawful procedures. Their experience in handling borrowers from numerous backgrounds and also economic circumstances enables them to deal with each instance with sensitivity and professionalism and reliability.

Effective Communication Methods With Borrowers

Efficient interaction approaches with debtors can greatly improve the success of finance collection initiatives. By establishing clear lines of communication, you can successfully share vital information and expectations to customers, eventually raising the likelihood of successful funding settlement. One vital strategy is to maintain routine contact with debtors, maintaining them notified concerning their outstanding balance, repayment options, and any changes in car loan terms. This can be done with different channels, such as call, emails, and even message messages, relying on the borrower's preferred method of communication. Additionally, it is important to use language that is clear, concise, as well as simple for debtors to recognize. Stay clear of making use of intricate lingo or technical terms that may puzzle or daunt debtors. Rather, emphasis on describing the circumstance in a uncomplicated as well as simple way. Another efficient strategy is to proactively pay attention to borrowers' concerns and also address them promptly. By revealing empathy and also understanding, you can develop trust and also rapport with borrowers, making them extra going to comply and locate an option. In general, reliable communication is the vital to successful lending collection efforts, so make certain to prioritize it in your collection techniques.Carrying Out Arrangement Techniques for Successful Financial Debt Recovery

When executing settlement strategies for successful debt recuperation, you can utilize energetic paying attention abilities to understand the borrower's point of view as well as discover equally valuable solutions. By actively listening to what the customer has to state, you can get useful understandings right into their economic scenario, factors for failing, and also possible payment choices. This will certainly enable you to tailor your settlement method as well as offer suitable solutions that resolve their problems.Energetic paying attention entails providing your full attention to the customer, maintaining excellent eye call, and also staying clear of diversions. It likewise implies asking open-ended inquiries to urge the debtor to share more information and also clarify their demands. By doing so, you can develop count on and relationship, which is critical for successful negotiations.

Throughout the arrangement process, it is important to remain calm, client, as well as empathetic. Comprehend that the borrower may be experiencing financial troubles and also may be really feeling overwhelmed. Be considerate as well as avoid judgmental declarations. Instead, emphasis on discovering common ground as well as exploring different payment alternatives that benefit both events.

Utilizing Innovation for Efficient Financing Collection

Utilizing technology can improve the process of car loan collection, making it much more effective as well as practical for both loan providers as well as debtors. With the introduction of advanced software and also online systems, loan providers can now automate numerous aspects of lending collection, saving time and also sources.Technology enables loan providers to track and also monitor loan repayments in real-time. Furthermore, continue reading this electronic documents and also documents make it easier to maintain precise as well as updated loan records, reducing blog the chances of conflicts or errors.

Overall, leveraging innovation in lending collection enhances effectiveness, minimizes prices, and also boosts the consumer experience. Lenders can concentrate on various other important tasks, while borrowers delight in the benefit of digital payment options and streamlined processes. Embracing modern technology in loan collection is a win-win for both parties involved.

Best Practices for Legal Actions in Loan Collection

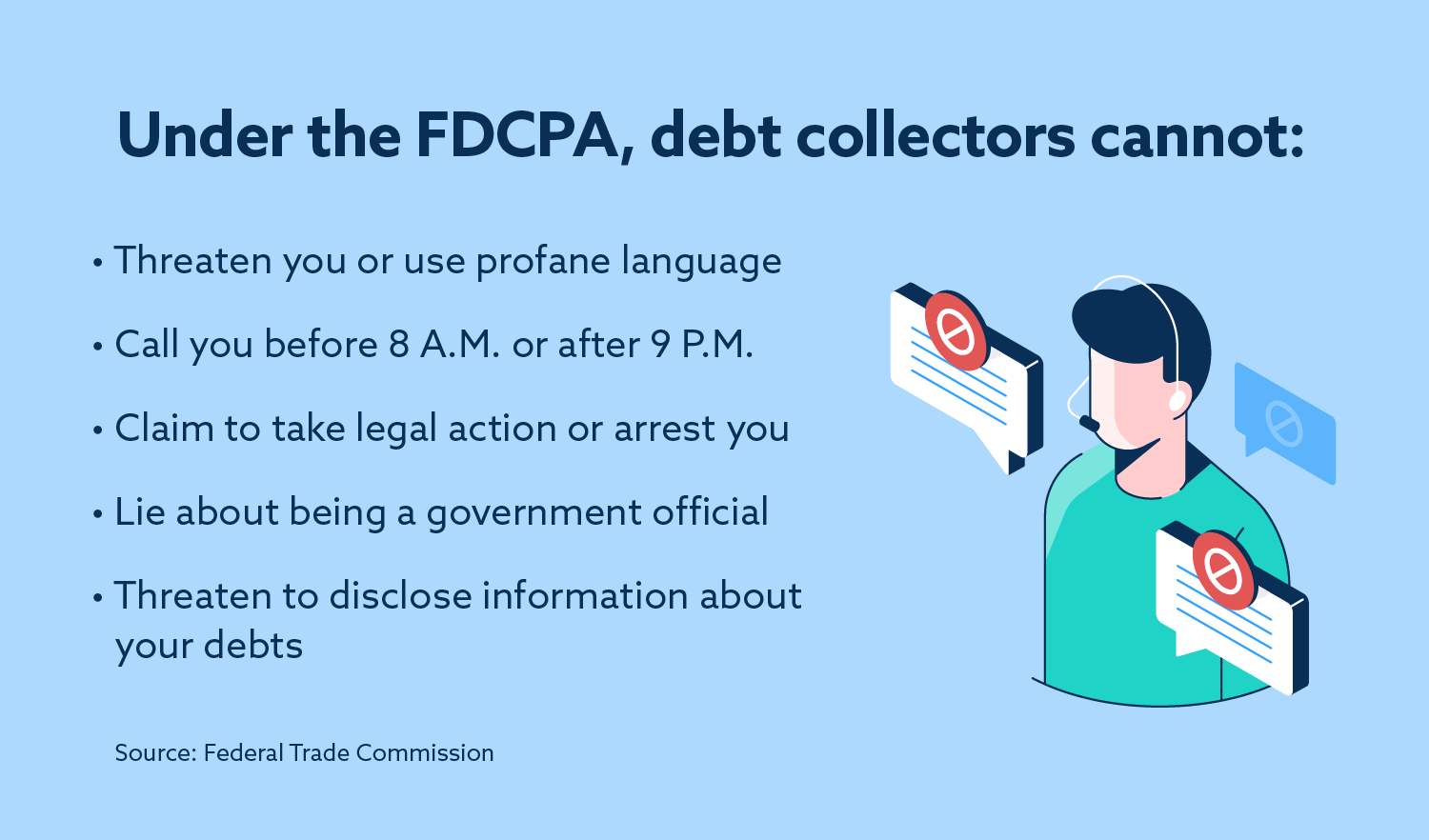

One of the ideal techniques for lawful activities in finance collection is to seek advice from skilled lawyers who concentrate on financial debt recuperation. It is crucial to have specialists on your side who understand the details of financial debt collection legislations and laws when it comes to lawful matters. These specialized legal representatives can supply you with the required guidance as well as know-how to navigate the intricate legal landscape and make sure that your car loan collection efforts are carried out within the boundaries of the regulation.

Furthermore, these lawyers can use important advice on different dispute resolution approaches, such as arrangement or arbitration, which can aid you avoid taxing as well as pricey court proceedings. They can also assist you in evaluating the threats and also possible end results of lawful actions, permitting you to make educated choices on exactly how to wage your finance collection initiatives.

Generally, seeking advice from with seasoned attorneys that specialize in financial debt recovery is an important ideal practice when it concerns lawful activities in car loan collection. Their experience can make visit here certain that you are adhering to the proper lawful treatments as well as optimize your opportunities of successfully recovering your fundings.

Final thought

Finally, when it pertains to loan collection, depend on the specialists who have actually confirmed strategies for success. By comprehending the funding collection procedure, executing efficient communication approaches, using arrangement strategies, and also leveraging modern technology, you can improve your opportunities of successful financial debt recuperation. If needed, it is vital to comply with finest practices for legal activities. Remember, relying upon experts in lending collection can help you browse the process with confidence as well as achieve the wanted results.Efficient interaction techniques with consumers can considerably improve the success of financing collection efforts (credifin). On the whole, reliable communication is the essential to successful financing collection initiatives, so make certain to prioritize it in your collection techniques

Report this wiki page